is there a death tax in texas

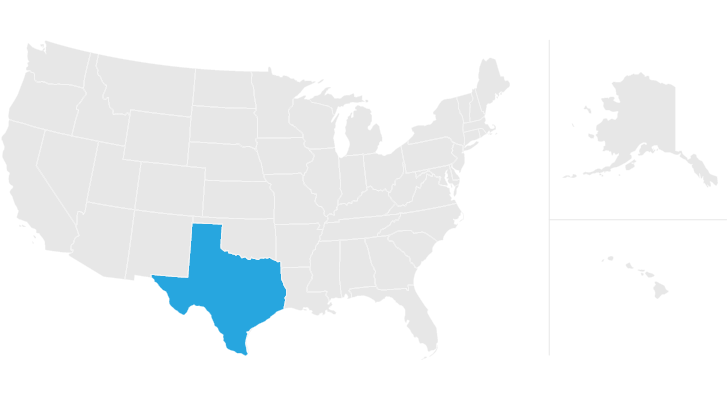

Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015. That said you will likely have to file some.

Do I Have To Pay Taxes When I Inherit Money

Because the state is free of inheritance tax heirs to an inheritance wont be taxed on it.

. The State of Texas has executed 574 people since 1982. No Inheritance tax rates. Prior to September 15 2015 the tax was tied to the federal.

One approach is giving the money or property in question to its intended recipient while youre still alive. The state repealed the inheritance tax beginning on Sept. There is a big exception to the no inheritance tax rule however.

For 2021 the IRS estate tax exemption is 117 million per individual which means that a. As noted only the wealthiest estates are subject to this tax. Theres no state income tax in Texas so there wont be taxes on Social Security and other retirement income.

Federal exemption for deaths on or after January 1 2023. A federal estate tax is a tax that is levied by the federal government and that is based on the net value of the decedents estate. Is there a death tax in texas.

Is there a death tax in texas. Someone will likely have to file some taxes on your behalf after your death though including the following. 71 million Estate tax rates.

Death Taxes in Texas. For the tax year 2021 a filing is required for estates with combined gross assets and prior taxable gifts. Understanding how texas estate tax laws apply to your particular situation is critical.

The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirs. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Federal estate tax return.

There are no inheritance or estate taxes in Texas. Or whether he got there. In Texas the assets that are left behind after a person dies become part of the deceaseds estate which is distributed to heirs and others through a variety of processes.

The answer under the current rules is that it depends. There are no inheritance or estate taxes in Texas. Final federal and state income tax returns.

Youll receive a gift tax exemption of. Theres no estate tax in Texas either although estates valued at more than 1206 million can be taxed at the federal level as of 2022. A surviving spouse between the ages of 55 and 65 can keep the decedents exemption by applying at their local tax appraisal office.

There is a big exception to the no inheritance tax rule however. It only applies to estates that reach a certain threshold. June 27 2011 558 PM CDT.

Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015. Prior to September 15 2015 the tax was tied to the federal state death tax credit. There is a 40 percent federal.

Sometimes the assets are subject to probate. On April 21 2022 the State carried out its first execution in more than six months putting 78-year-old Carl Wayne Buntion to death. Federal estatetrust income tax return.

Already the District of Columbia has toughened its estate tax levy effective January 1 2021. When a Texas resident dies without having made a last will and testament they are automatically entered into the states intestacy probate process. Texas does not levy an estate tax.

The state of Texas does not have any inheritance of estate taxes. The federal estate tax sometimes called the death tax is a one-time tax that is imposed at death. When someone dies their estate goes through a legal process known as probate.

These taxes are levied on the beneficiary that receives the property in the deceaseds will. Inheritance and Estate Taxes. A persons death terminates his or her taxable year.

After the homeowners death if the estate. These federal estate taxes are paid by the estate itself. In August Mayor Muriel Bowser signed the Estate Tax Adjustment Act reducing the exemption from.

The affidavit must be provided to the county tax assessor-collector along with Form. 108 - 12 Inheritance tax. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million.

There would be no tax due on the first spouses death. The Texas Probate Code Title 2 Subtitle E Chapter 201 is the law. Each state controls the functioning of this process through the intestacy succession laws found in that states probate tax code.

Death and Taxes. The siblings who inherit will then pay a 11-16 tax rate. This means that if a person passes away on June 1 2009 that persons final income tax return will cover only the period from January 1 2009 until June 1 2009.

Taxes imposed by the federal andor state government on someones estate upon their death. The taxes plus interest plus a penalty keep adding up until the elderly or disabled homeowner dies. The state repealed the inheritance tax beginning on Sept.

Is there a death tax in texas. Currently estates under 114 million are. Yes Estate tax exemption level.

Pin On Family Law UT ST 59-11-102. Texas Department of Criminal Justice PO Box 99 Huntsville Texas 77342-0099 936 295-6371. In some cases heirs may have to pay tax as well depending.

Then the estate must pay the taxes interest and penalties. Of these 279 occurred during the administration of Texas Governor Rick Perry 2001-2014 more than any other governor in US. A final income tax return will be required if the decedents income exceeds the filing thresholds established under the.

If the estate is large enough then it may have to pay estate tax. The Texas Observer is known for its fiercely independent uncompromising work which we are pleased to. Then the estate must pay the taxes interest and penalties.

Texas Estate Tax Everything You Need To Know Smartasset

What Is The Probate Process In Texas A Step By Step Guide

Talking Taxes Estate Tax Texas Agriculture Law

Texas Estate Tax Everything You Need To Know Smartasset

Deed In Texas Texas Law Texas Business Profile

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is It Hard To Sell A House With A Quitclaim Deed It S An Inexpensive Way To Transfer Property And While An Owner Quitclaim Deed Things To Sell Property

When Should A Trust Be Terminated Republic Of Texas Trust Knowledge

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Estate Tax Everything You Need To Know Smartasset

Four Types Of Deeds In Texas 1 General Warranty Deeds 2 Special Warranty Deeds 3 No Warranty Deeds 4 Quitc Power Of Attorney Knowledge The Hamptons

When Can You File A Homestead Exemption Canning Dallas Real Estate Homesteading

Report States With No Income Tax Get No Economic Boost Income Tax Income Charts And Graphs

Cadilac Law Pllc For More Information Please Call Us Now At 972 845 1200 Www Cadilaclaw Net Subscribe Https Www Youtu Tax Protest Business Help Law Firm